Leverage LRE’s strong development pipeline and well–diversified portfolio of operational assets for a risk–tolerant investment that offers more revenue certainty than others through market cycles.

Integrity Creates Results

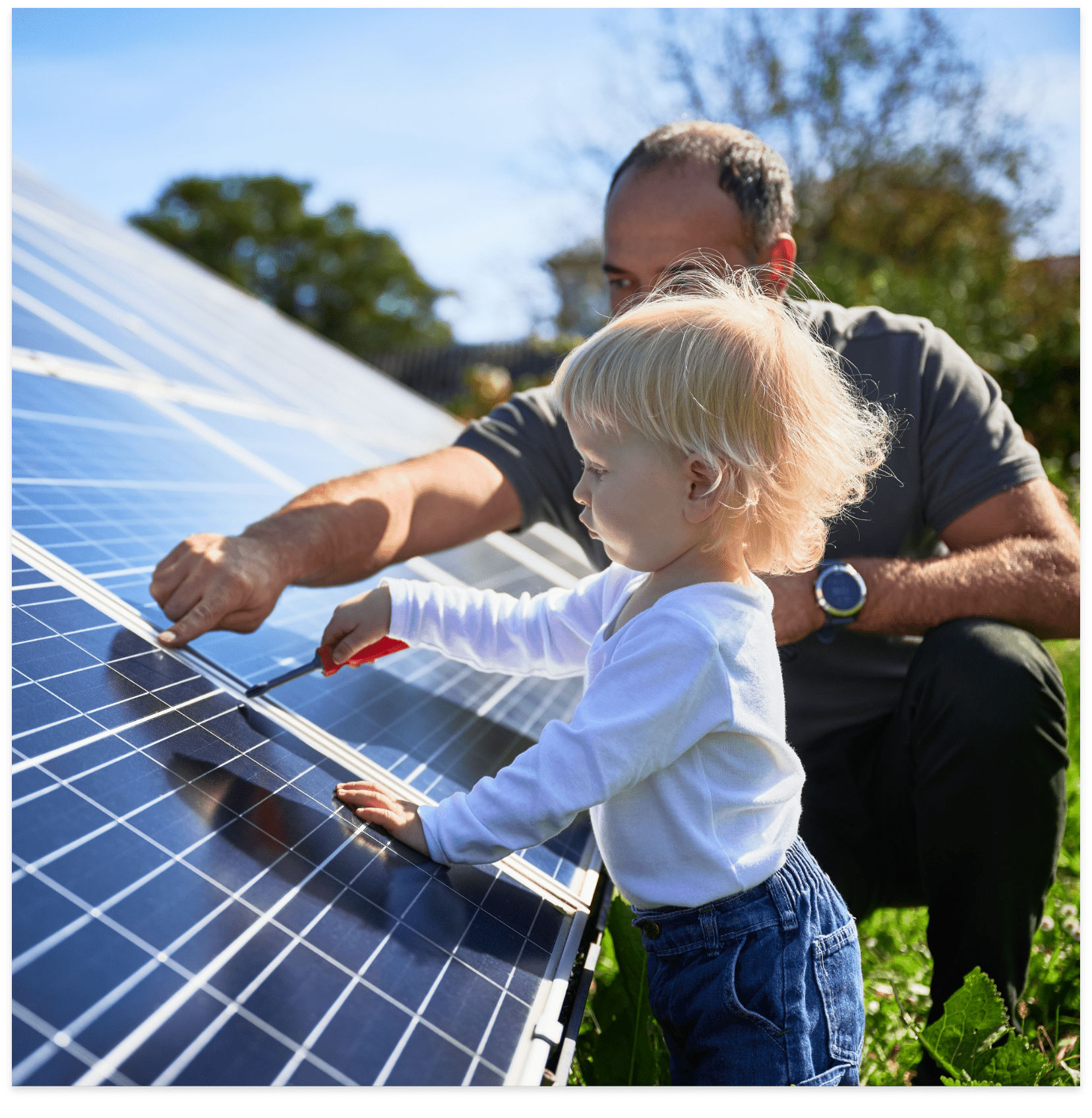

LRE has built a 20-year legacy as an owner and operator of wind, solar, and energy storage facilities in energy markets across the U.S. Under guidance from a deeply experienced management team, our team shares a common purpose to build a sustainable future for all.

RESPONSIBLE STEWARDSHIP

Leveraging our strong development pipeline and well-diversified portfolio of operational assets, LRE is pursuing a high-growth strategy that will position the company as one of the top renewable energy players in the country by 2028, with roughly 10 GW of operating and contracted capacity. As part of that process, we plan to engage in various asset realization approaches, including acquisitions and sales, to optimize our portfolio.

TRANSPARENT PARTNERSHIP

Investing in LRE (Leeward Renewable Energy) means partnering with a company founded on integrity. We hold ourselves to the highest standard of ethical business practices. To ensure transparency in our operations, we are enhancing our environmental, social, and governance (ESG) practices to better serve our investors and financial partners.

DIVERSIFIED PORTFOLIO

Our wind, solar, and energy storage capabilities continue to grow through ongoing investment in our existing portfolio and our active pursuit of new opportunities through greenfield development and acquisition opportunities. We currently have 30+ GW of wind, solar, and battery storage projects under development spanning over 130+ projects.

GREEN FINANCING FRAMEWORK

The LRE Treasury team, in coordination with Project Managers, reviews, selects, and monitors projects that align with our Green Financing framework. On a quarterly basis, the same group also reviews the compliance of the financed Eligible Green Projects and is responsible for replacing projects that, for any reason, become non-compliant with the criteria described in this framework.

GREEN BOND FRAMEWORK

We regularly analyze our environmental and social impacts and assess how we can mitigate impacts on the communities in which we operate. The LRE Green Bond Framework is aligned with the four core components of the Green Bond Principles, 2021 (“GBP”), as administered by the International Capital Market Association (“ICMA”).

Supporting Sustainable,

Long-Term Clean Energy Production

Thriving Environments

A renewable future with a purpose-driven company committed to fostering environmental stewardship, sustainability, and safeguarding biodiversity.

Thriving Communities

Learn more about how our work helps local communities thrive through ethically managed, environmentally responsible power generation.

Let’s build sustainable solutions together.

Let us show you how responsible renewable energy projects from LRE generate jobs and deliver reliable power for generations to come.

"*" indicates required fields